Updates on noteworthy initiatives across the retail media marketplace from Mars United’s Commerce Media team.

To keep the industry updated between the quarterly editions of our Retail Media Report Card, Mars United Commerce is monitoring the efforts at leading retailers and platforms to improve and expand their capabilities and services.

We’re focusing on the initiatives that are expected to impact the way advertisers effectively plan, execute and measure their marketing programs on these networks, either directly through new behind-the-scenes tools and capabilities, or indirectly through shopper engagement activity that will enhance (or at least alter) the way brands interact with shoppers.

The information covered in these updates will be used by our Commerce Media analysts to inform the network assessments presented in future editions of the Report Card.

__________

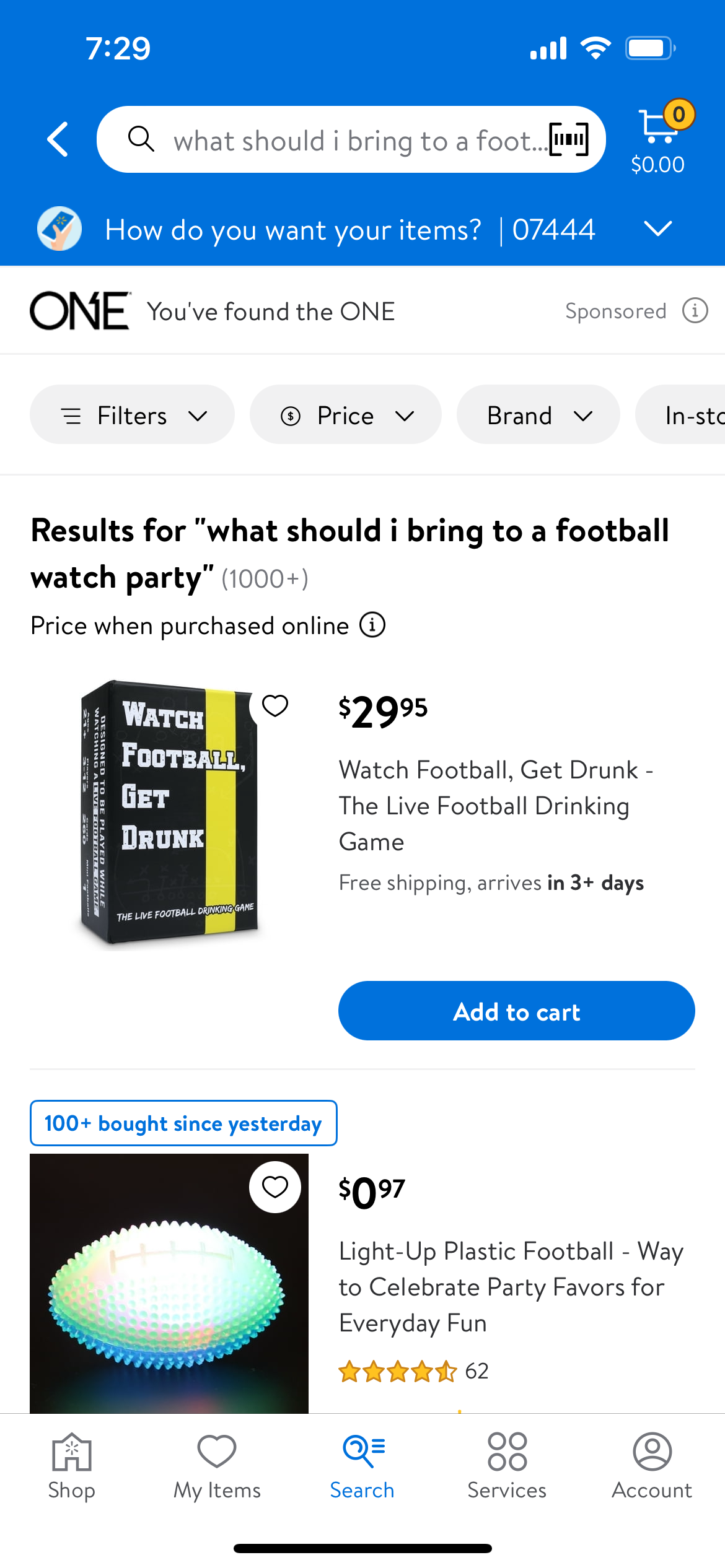

Walmart Takes Center Stage with GenAI Search

The world’s largest retailer made a big splash at the world’s largest technology show last month, when CEO Doug McMillon used the keynote stage at CES in Las Vegas to introduce an array of technology-driven “adaptive retail” initiatives designed to deliver a more convenient and enjoyable shopping experience.

Topping the list is a new GenAI-fueled search function that lets shoppers search by specific use cases to receive cross-category results reflecting all the products that might solve their needs. Already available on the Walmart app for iOS users, the feature “can help Walmart customers spend more time doing the things they enjoy and less time scrolling, tapping and searching,” according to the company.

To deliver the most relevant results, the new search tool factor’s in the user’s location, search history, and other contextual information by employing proprietary Walmart data and technology, as well as the large language model of partner Microsoft Azure and a retail-specific model built in-house.

Mars United will take a deep dive into the implications for brands of all Walmart’s CES announcements next week.

____________

Walmart Connect Launches Brand Term Targeting

Walmart Connect is now allowing brand term targeting for ad placement in its Manual Sponsored Products, Sponsored Brand and Sponsored Video programs. Advertisers can now bid on keywords related either to their own or competing brands and products. (Walmart private labels are currently not eligible.)

These new options can help brands gain new shoppers by targeting the competition’s buyers or protect and maintain their own share of voice while keeping competitors from taking it. With the competitive bids, competitive brands won’t show up in the first two slots of search results. A winning competitive bid will increase the organic ranking for that branded term.

Brands participating in these new options should compare their performance for efficiency and effectiveness with the competitive conquesting activity they’re conducting through Amazon Ads.

____________

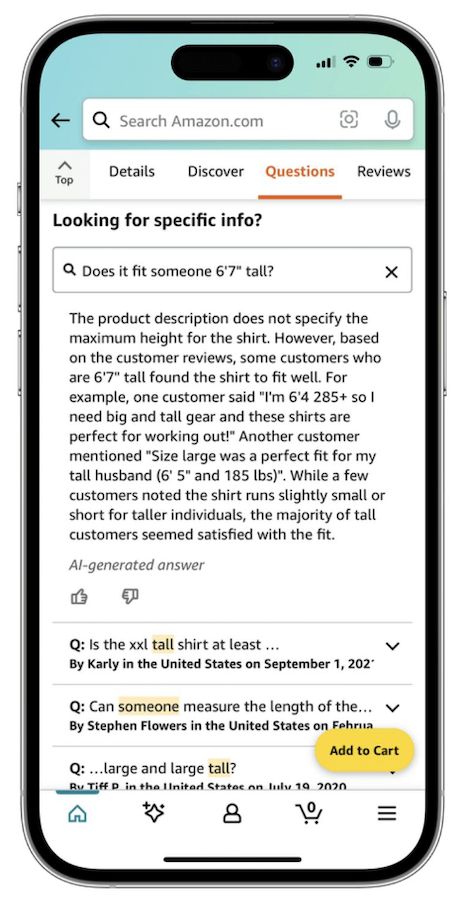

Alexa, Make Room for Rufus

A few weeks after Walmart unveiled its GenAI-powered search functionality, Amazon introduced “Rufus,” a conversational search assistant currently in beta within the retailer’s mobile app. Trained on the Amazon product catalog and internet-wide content, the service is designed to save shoppers the trouble of scrolling through search results or endlessly reading customer reviews by answering questions about their needs or specific product queries, then making recommendations. At the moment, Rufus doesn’t compare products or offer pricing information.

Jack Lindberg, Mars United’s resident Amazon Marketing Cloud expert, offers his perspective on the new technology here.

____________

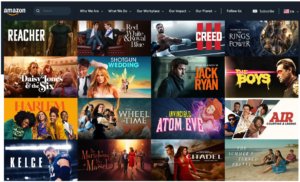

Amazon Prime Video Launches Ads

Amazon Prime Video became a full-fledged advertising platform in January as the ecommerce giant began placing paid spots within its programming — and offering subscribers a $2.99 monthly surcharge to avoid seeing them. This shift in Amazon’s streaming strategy is expected to have a major impact on the digital advertising landscape.

While media coverage of the event focused on the competition Amazon Prime will face from other streaming TV publishers like Netflix and Walt Disney, these opportunities should also have a significant impact within the retail media network arena as well, where advertisers increasingly are seeking full-funnel opportunities that leverage first-party shopper data like that available through Amazon Ads and the Amazon Marketing Cloud. Amazon Ads’ CPM (cost per thousand viewers) rates are lower than many other RMNs, which means other retailers will likely need to respond in some fashion.

Similarly, while some analysts are expecting Amazon to focus their sales efforts on non-endemic advertisers (auto makers, restaurant chains, insurance companies), CPGs and other more traditional ad partners will likely be leaning into the opportunity.

____________

Albertsons Adds GenAI for Media Planning …

Albertsons Media Collective has entered into a partnership with Capgemini to use the latter company’s intelligent process automation technology for enhanced media planning, media operations and content creation. In addition to automating media planning and activation, Capgemini’s generative artificial intelligence and other tools are expected to unlock deep learning insights for media planning and optimize creative versioning in real time.

“The advertising industry is ripe with potential to integrate AI, and we see a massive opportunity to leverage process automation to streamline our workflows, drive enhanced campaign performance and accelerate speed to market,” said Kristi Argyilan, SVP of retail media for Albertsons Media Collective. Capgemini is promising a 20% improvement in speed to market for campaigns, along with greater flexibility, efficiency and performance.

____________

… and Taps Criteo for Sponsored Ads

Elsewhere, The Collective signed a deal with Criteo to manage the network’s onsite sponsored ad offerings, which will expand in the coming months to encompass new formats including onsite display and sponsored video. (CitrusAd previously managed the service.)

Through the partnership, advertisers will be able to buy and execute onsite sponsored ad campaigns leveraging The Collective’s first-party data and shopper signals through Criteo’s Commerce Max self-service demand side platform. “We are confident that integrating Criteo into our operations will enhance our client services to better support brands and agencies through expanded service models and channels,” said Harvey Ma, Vice President at The Collective.

____________

Instacart Gives In-Store Ads a Test Drive …

In January, Instacart began piloting the delivery of personalized in-store advertising through the digital screens of the Caper Cart smart shopping carts it supplies to retailer partners. The program began at Bristol Farms stores in Southern California but should soon roll out to other chains. Ad programs will include product recommendations based on a shopper’s real-time behavior (an ice cream offer when cones are placed in the cart), as well as more standard new-product offers, deals and seasonal promotions that can be targeted to past purchase behavior.

Instacart promises to have thousands of Caper Carts deployed by the end of 2024. Participating retailers get a share of the ad revenue. Instacart Ads already powers the online retail media activity of regional chains Schnucks, Sprouts, Price Chopper and Tops.

____________

… and Opens Off-Platform Targeting

Elsewhere, Instacart has made Google Shopping campaigns accessible to its ad partners. Brands can now use Instacart’s first-party shopper data to target audiences in campaigns running on the Google platform.

“Over the last year, we’ve extended the power of Instacart Ads off-platform with a number of partners and now we’re enabling our brand partners to reach the right audience while they search on Google and seamlessly drive them to purchase on Instacart,” said Laura Jones, the last-mile delivery service’s Chief Marketing Officer.

In an early pilot, more than 50% of Google Shopping purchasers were new to the brand in the last six months, Instacart said.

____________

DGMN Selects Neptune as In-Store Signage Partner

Beginning April 15, Neptune Retail Solutions will replace Inmar Intelligence as the in-store signage provider for the Dollar General Media Network. The media portfolio will continue to include shelf signage, security pedestal shrouds, ads on outdoor concrete bollards, and basket liner ads. Neptune is guaranteeing 90%-plus installation compliance across Dollar General’s 19,000-odd stores.

Since Neptune already handles Dollar General’s weekly ad and digital coupon programs, this move could lead to easier ad bundling for brands. With the retailer lacking any appreciable ecommerce presence, DGMN needs to establish a strong package of in-store opportunities.

____________

Elsewhere in the RMN Landscape

Beginning Feb. 21, Wakefern Food Corp. will shift operation of its self-serve media platform for onsite display and sponsored product from CitrusAd to Inmar Intelligence. It’s the first entry into the sponsored products/search arena for Inmar, which already handles Wakefern’s offsite media activity.

Wakefern, the East Coast supermarket cooperative guiding 365 stores (most operating under the ShopRite banner) is seeking to grow its retail media network opportunities, which along with search and onsite display currently include recipe pages. The new platform is expected to have both managed and self-service options.

Germany-based discount grocer Aldi has opened a dedicated center of excellence in the UK and is recruiting specialists to begin building a retail media network across all its markets, which include Australia and China in addition to Europe and the U.S., according to reports. Mark Hardy, formerly Global Business Coordination Manager, was named International Media Manager last November.

Aldi has roughly 2,300 U.S. stores across 38 states and is in the midst of buying 400 Winn-Dixie and Harveys supermarkets from Southeastern Grocers. It also launched U.S. ecommerce capabilities in 2023. Infrastructure for the media networks is expected to be built at the country level, but it’s still unclear if Aldi will look to sell advertising across markets — or who the target advertiser might be, given that 90% of its product inventory is private label.

____________

Mars United Commerce is an independently owned global commerce marketing practice that aligns people, technology, and intelligence to make the business of our clients better today than it was yesterday. Our worldwide capabilities coalesce into four key disciplines — Strategy & Analytics, Content & Experiences, Digital Commerce, and Retail Consultancy — that individually deliver unmatched results for clients and collectively give them an unparalleled network of seamlessly integrated functions across the entire commerce marketing ecosystem. These disciplines are powered by our industry-leading technology platform, Marilyn®, which helps marketers understand the total business impact of their commerce marketing activation, enabling them to make better decisions, create connected experiences, and drive stronger, measurable results. Learn more at https://www.marsunited.com