Implications for brand, retailers, agencies and third-party partners as the marketplace matures

By Nicole Rainey, Mars, Inc.

Ethan Goodman, EVP, Commerce Media, The Mars Agency

Where We Are Today (Ethan)

Morgan Stanley is now predicting that retail media ad spending will reach $130 billion globally by 2025, a total that more than doubles previous forecasts for the marketplace.

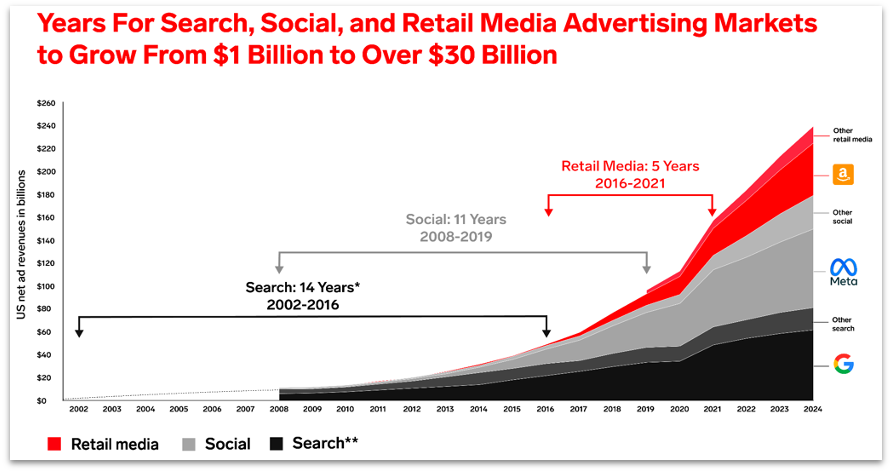

While it took ad spending on search 14 years to grow from $1 billion to $30 billion and social media 11 years to make that trajectory, retail media got there in only five, according to eMarketer. That is a staggering increase that reflects the rapid pace of industry growth we’ve witnessed in the last few years.

Source: Insider Intelligence/eMarketer

There have been five primary factors for this unprecedented growth:

1. The COVID-accelerated rise in ecommerce. Tens of millions of consumers began shopping digitally almost overnight, bringing more traffic and more transactions to retailer websites.

2. The demand for first-party data. Retail media networks maintain a wealth of first-party shopper data that is completely unique to any consumer data available elsewhere across the advertising landscape. They also operate uniquely valuable owned assets online, on mobile devices and in physical stores that can be used to reach these shoppers in relevant moments.

3. The expected demise of third-party cookies. If and when Google finally gets its act together and the industry formally moves toward third-party cookie deprecation, that will place an even greater premium on the first-party data available in the walled garden ecosystems.

4. The growing need for retailer profit. As more of their business shifts to ecommerce, where already slim profit margins get even thinner, retailers are looking for more profitable alternative revenue — and retail media is a really good place to find that.

5. A proven blueprint for success. Amazon has shown the industry what the potential for retail media looks like: a still-growing $40 billion business. That has gained a lot of attention from other players in the retail industry.

Adopting an Omnichannel Mindset (Nicole)

The result of all this? More and more retail media networks are launching. We know they can be effective in reaching our shoppers and driving the business. But as marketers, we need to take a step back and ask, “Is this sustainable? Your shopper budget is probably not growing to meet the demand, and while the largest retailers have the audience scale (and yes, the clout) to warrant investment from your national media budget, the second-tier networks now emerging likely don’t.

So how do we decide which networks to fund? We have to make prudent choices about where to invest and how much spending even makes sense. As the choices grow, we need to figure out how to evaluate these networks to make sure we’re making the right investment decisions.

The Mars Agency’s Retail Media Report Card gives us a great starting point for understanding and comparing the capabilities and opportunities across different networks. We overlay that information with our internal media criteria to help us make decisions.

What’s more, as these networks have become more popular, the finite amount of onsite inventory they have available to sell is limiting growth, so they’re looking for new ways to make that first-party data and closed-loop attribution available to advertisers. That has them extending into connected TV (like the Kroger and Disney+ partnership), into their own physical stores (see Walmart’s recent efforts), and more broadly into social media (TikTok is partnering with a growing number of networks).

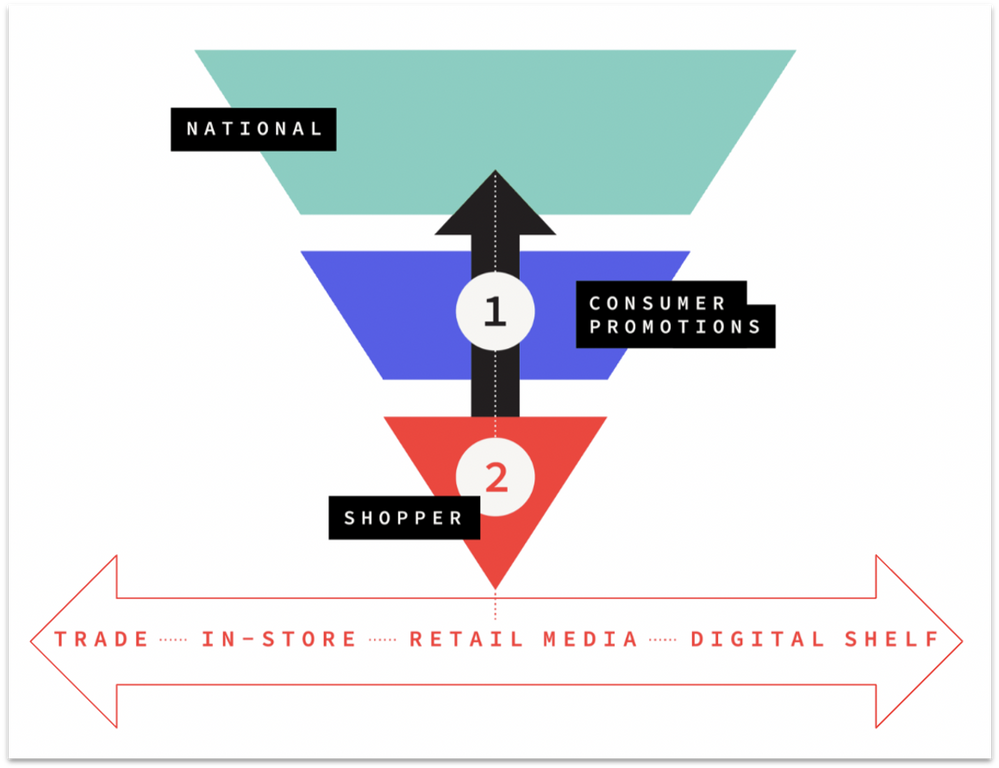

Strategically, as networks continue moving into omnichannel capabilities, we’re starting to consider changing our media criteria across the purchase funnel to adopt more of an omnichannel mindset. As the traditional purchase funnel collapses, as consumers become more fluid in the way they shop, we need to think about how to reach them differently by integrating our ways of working. Even a few weeks ago, we were still thinking about national vs. shopper criteria; now, we’re challenging ourselves to think more omnichannel. And that requires us to integrate both vertically and horizontally:

Horizontally, to make sure we’re aligned on everything we do from a customer perspective, making sure that sales, shopper, trade and ecommerce are connected.

Vertically, to make sure our national and shopper media teams are connected, through plans that aren’t competing or double-dipping, but that also have common reach and frequency goals to leverage these retail media capabilities — like retargeting and sequential messaging — to build a complete omnichannel plan.

And as we’re thinking more omnichannel, we need the networks to offer not just omnichannel products, but omnichannel solutions. Here are just two:

- Retargeting shopper media off your national media is a really cool way to integrate the two activities, but how do we make that seamless to bring the connected consumer experience to life?

- How can we measure attribution for both our national media tactics and our shopper media tactics when they have different goals?

Making Smart Investments (Nicole)

Marketers are feeling the pressure from some networks to make substantial investments. In the most extreme cases, we’ve been asked to spend 2% to even 10% of our gross sales at that retailer. That’s a lot of money, and it makes the investment feel more like a tax or a pay-to-play than a partnership. And our budgets simply aren’t growing as fast as the asks.

To help us make smarter investments, we need to consider initiating integrated joint business planning across media and merchandising. Let’s take a step back and think about the overall investment with the retailer: How much does it make sense to spend collectively with this partner, and then how should we allocate that investment effectively across the opportunities? And the more we spend, the more we should be getting in return.

We don’t expect changes like that to happen overnight. But the more we can start thinking collectively across functions — both internally and with the networks — today, the better we’ll position ourselves for a better tomorrow.

We do expect that kind of joint business planning to take hold. Being part of a retailer gives these media networks a distinct advantage because it lets them offer added value that other media publishers can’t deliver. So it’s only logical to start talking about what advertisers can get “on the other side” in terms of increased product distribution, merchandising, secondary display, or even additional digital opportunities if they’re going to make huge investments in the media. Merging these two discussions will create really powerful omnichannel planning.

Albertsons Media Collective and some other networks have already started bringing their merchant teams to their top-to-tops meetings with key advertisers. We’ll need to see more of this connectivity if retail media is really going to achieve that $130 billion forecast.

Where We’ll Be Tomorrow (Ethan)

Along with the expected progress toward some of the best practices already discussed, we at The Mars Agency expect the following three trends to have a significant impact on the future of retail media.

1. The Emergence of Clean Rooms

This is already happening, but we’re calling it a future trend because we expect the proliferation of data clean rooms to gain a lot more momentum in the next few years.

It shouldn’t surprise anyone that Amazon is leading the charge here, too, through the Amazon Marketing Cloud. The Mars Agency is working closely with clients as we build up internal services and technology to help them optimize the AMC platform.

Clean rooms provide an opportunity to better target audiences, improve measurement capabilities and personalize campaigns to a much greater degree. We’re already using AMC to conduct some really powerful measurement analysis. We’re mapping customer journeys; we’re identifying the impact of shopper exposure across multiple touch points within the Amazon ecosystem.

Other retail media networks are getting hip to the need for data clean rooms and building solutions of their own, like the pilot between Albertsons and Pinterest announced earlier this year or the work that third-party data platform LiveRamp is doing with several networks.

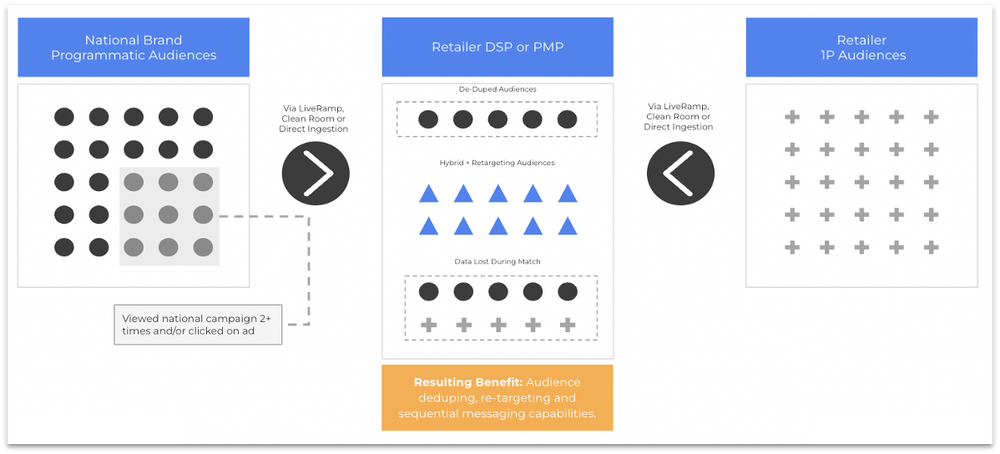

We’re very excited about the impact on measurement, of course, but we’re even more passionate about the potential for clean rooms to help brands vertically integrate audiences and avoid duplication or over-saturation.

Clean rooms let brands align their national media audiences with the retailer’s first-party shopper audiences in a shared environment and thereby unlock true full-funnel audience management and media activation — through tactics like retargeting and sequential messaging, as Nicole mentioned earlier. This is an extremely exciting opportunity.

2. Measurement Beyond ROAS

Although improvements have been made, there still is a general lack of sophistication around retail media measurement. ROAS has been the primary metric to date, but that shouldn’t be the only one used. There is a lot of industry momentum among both retailers and third parties like the IAB to both standardize retail media measurement across platforms and to make industry practices more sophisticated.

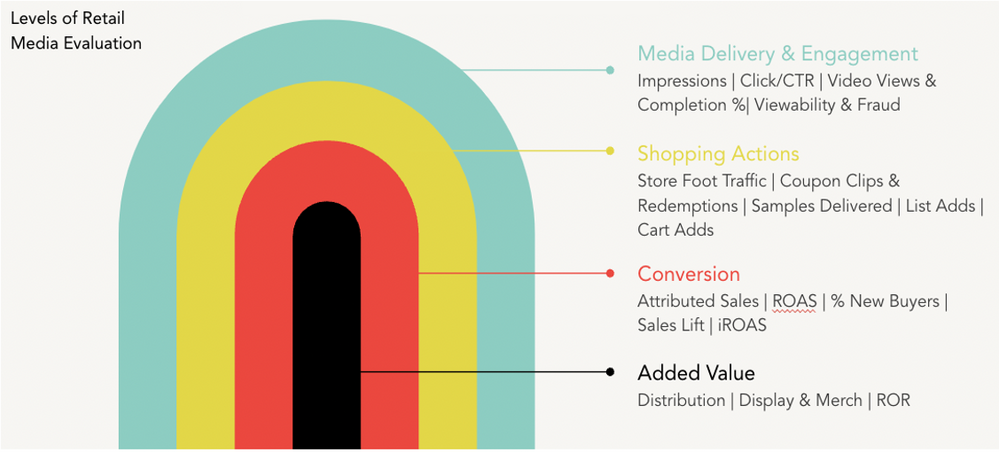

At The Mars Agency, we strive to measure the “Total Business Impact” of retail media by evaluating four different performance levels:

- Media delivery and engagement: You certainly need to measure performance as you would with any other media: impressions, clicks, viewability. Importantly, this lets you make apples-to-apples comparisons with other media.

- Shopper actions: You also need to understand the media’s effect on behavior — things like store visits and coupon redemptions.

- Conversion: You need to understand the sales impact — but not just attributed sales and ROAS as reported by the networks, but also an independent third-party analysis to get the complete picture.

- Added value: As already discussed, we need to ensure that our investments are yielding benefits beyond the media and even beyond sales performance. We work with clients to leverage their investments to gain added value on the merchant side of the house.

We are really excited to help advance this conversation on measurement. It’s one reason why we launched our Retail Media Report Card, and it’s also why we’ve been supporting the IAB’s efforts.

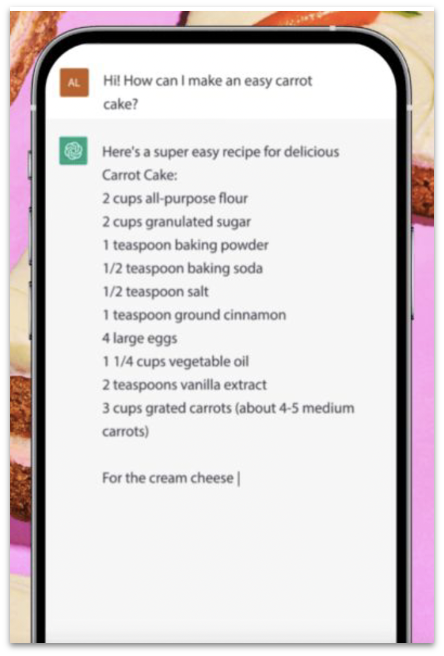

3. The Promise of Generative AI

Generative AI has taken the marketing world by storm, but the majority of use cases we’ve seen so far revolve around conversational AI and chat functionality. From a media perspective, we at The Mars Agency might be more excited about the sheer computational power that gen AI can bring to:

Predictive planning: Ultimately, gen AI can probably get us 80% of the way to an effective media plan based on historical performance and numerous other environmental factors. Our “human” planners can use their expertise to do the final 20% of the work and make each plan perfect.

Creative: We’re already doing a mind-blowing amount of creative versioning to deliver personalization, and some of it is already automated using DCO and other tools. Here, too, letting gen AI do 80% of the work will make the process even more efficient.

Optimization: We have scores of hands-to-keyboard search and DSP media buyers who are working in these media platforms every day to optimize campaigns. Automating more of this work through gen AI will free those people up to take on more strategic activities.

That represents our current POV on retail media: an already beneficial today followed by an even more promising tomorrow.

About the Authors

As Senior Retail Media Manager at Mars Wrigley, Nicole Rainey sits on the U.S. National Media Team and oversees the holistic retail media strategy. Her background in shopper & ecommerce at Mars, Inc. and media planning on the agency side is a key enabler for driving integration across national and shopper activity. Part of her role in setting the retail media strategy is helping enable cross-functional collaboration to unlock more value from negotiations, drive standardization across buys, and customize as needed.

The Mars Agency’s SVP-Commerce Media, Ethan Goodman is a renowned marketing strategist with deep expertise in digital commerce and shopper marketing. Prior to his current role, Ethan built, grew and managed The Mars Agency’s Ecommerce and Innovation practice groups, and also guided the team that created SmartAisle — the world’s first voice-powered shopping assistant for brick & mortar retailers.