By Katherine Barks, The Mars Agency

A growing global practice gives The Mars Agency insights into shopper behavior and the business of commerce across a wide range of countries. Here, the agency’s Toronto-based Retail Solutions team looks at recent consumer trends that are having a significant impact on the Canadian grocery channel.

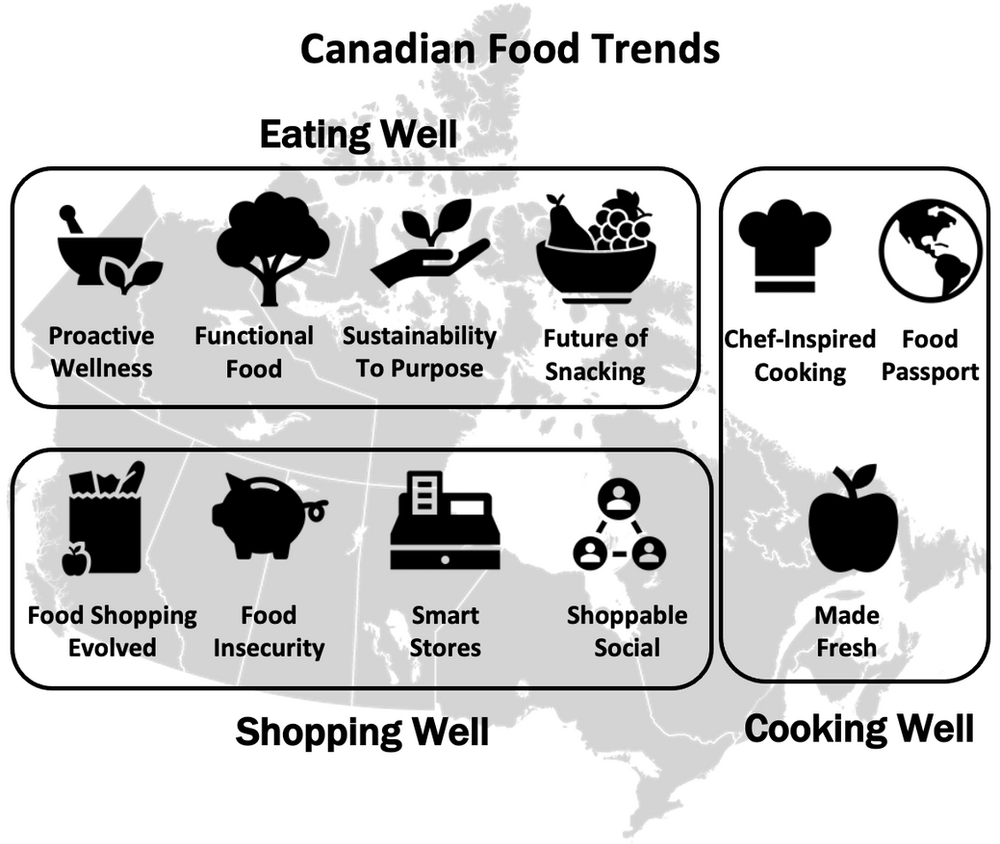

In a series of three articles, we’ve provided a brief overview of each trend, along with one actionable idea for brands to consider. Article 1 covered Eating Well trends, and Article 2 explored Cooking Well. The final article looks at:

PART 3: Shopping Well

1. Food Insecurity

The average four-person Canadian household spent roughly $14,000 on food in 2021, an increase of almost $700, according to Canada’s Food Price Report 2021.

With their costs increasing, Canadian consumers are looking for ways to save: 78% are concerned about food prices enough to change how they shop, according to Nourish Network; as one example, 49% have reduced their meat purchases due to higher prices, a Field Agent survey found.) Shoppers are more price sensitive on categories they purchase frequently, although less so with fresh foods. And, according to NielsenIQ, 82% consider private label to be a good alternative to national brands.

Given all these tendencies, loyalty levels may be decreasing as consumers shop more on price and pantry-load on items when they find good deals.

Elsewhere, as consumers continue looking for ways to reduce spending, some may decide that “convenient” food delivery options are an unnecessary expense, which could lead them back to in-person trips to discount grocery stores. Others, however, might still be willing to a pay a premium for the time savings involved.

In another cost-conscious trend, Canadians are taking advantage of food-sharing apps like “Too Good To Go,” which connects deal seekers with grocers and restaurants eager to avoid throwing away aging but still-edible food. App users pay $3 to $10 per week to receive prepared lunches/dinners, a week’s worth of fruit, vegetables, bread and pastry — even, entire pizzas and cakes.

ACTIONABLE IDEA:

Curate inexpensive meal solutions that will benefit cost-conscious shoppers while helping

retailer partners enhance the shopping experience.

______________________________________________________________

2. Smart Stores

Shopping in brick-and-mortar stores has gotten a lot more sophisticated — from electronic shelf labels and digital wayfinding tools to smart carts and even checkout-free stores (like Amazon Go).

Now that consumers have grown comfortable with grocery shopping online, the two worlds are blending. From in-store shoppers using their smartphones and scanning QR codes to learn more about products and promotions, to smart carts that help them not only navigate the store but also find recipes and product suggestions — and then check out without standing in line (like Kroger’s KroGo pilot in the U.S. See below).

Digitalization lets shoppers better design their own experience. But it also helps store employees improve the experience by monitoring out-of-stock situations and aisle clean-ups. What’s more, it can identify future needs by tracking aisle traffic and dwell times, giving retailers the insights needed to further improve the experience.

ACTIONABLE IDEA:

Add QR codes to packaging that link shoppers

to relevant product content and/or special offers.

______________________________________________________________

3. Shoppable Social

Globally, social commerce is expected to grow three times as quickly as traditional ecommerce. The growth will be driven by Gen Z’ers and Millennials, who are expected to account for 62% of global social commerce by 2025. Social commerce is more intimate than ecommerce because it creates a sense of community and connection.

This convergence of social media activity and ecommerce through technologically enabled platforms will be an increasing focus for both retailers and brands moving forward.

The attention is fully warranted, according to Canadian engagement numbers compiled by Hootsuite:

- There are 32.2 million active social media users, which represents 85% of the Canadian population (and an 8% increase vs. 2020).

- Average daily time spent using social media is 1:46.

According to Accenture, 80% of Gen Z’ers (18–34 years) say they discover new foods or recipe ideas on social media, and 36% say they’ve purchased a food product after seeing it in a social media post. Across all demographics, 47% of Canadians have purchased through social media, according to Retail Insider.

Consumers want to buy products and services based on the recommendations and inspiration they get from people they trust. This could be personal family, friends and communities, but it also could be authentic influencers they follow on social media. These influencers can therefore help brands connect with relevant, receptive audiences.

Retailers are reacting. In one example, Walmart U.S. announced last December that it would team up with live-streaming social commerce provider TalkShopLive. The partnership enables Walmart to deliver shoppable content through embedded videos across platforms and properties. All brands distributed by Walmart will be able to use the TalkShopLive platform, which is fully integrated into the retailer’s commerce API.

ACTIONABLE IDEA:

Pilot a livestream cooking event series

with a key retailer partner.

______________________________________________________________

4. Food Shopping Evolved

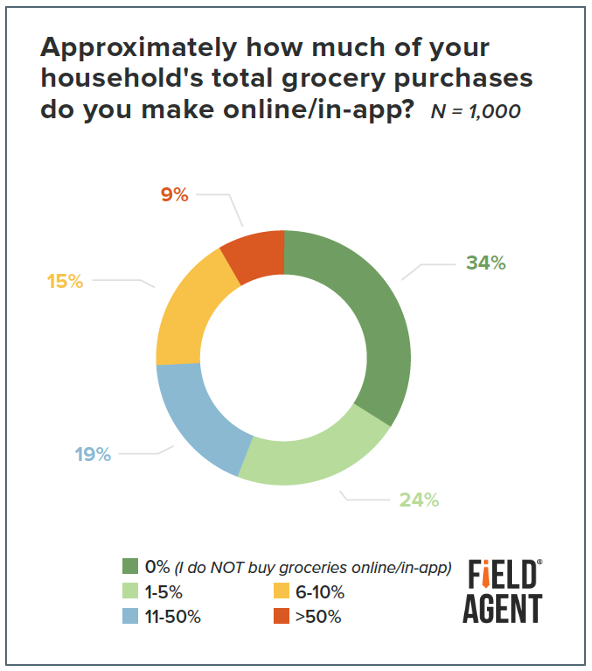

In Canada, 66% of consumers have shopped for groceries online, according to Field Agent.

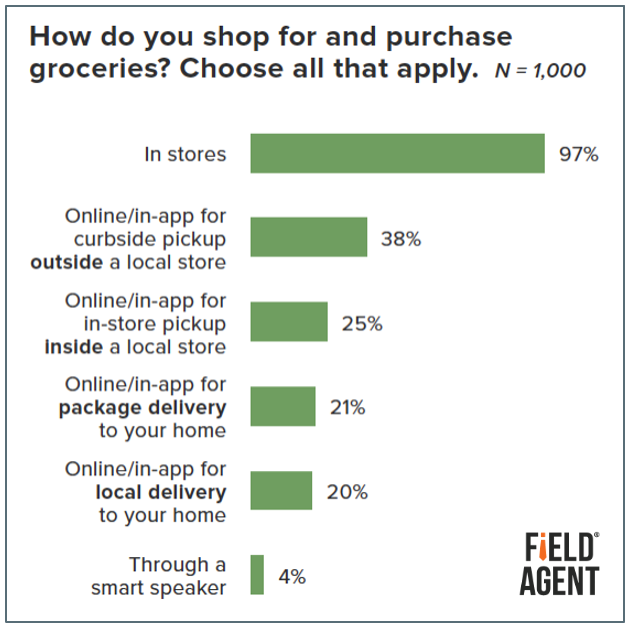

While most still make the majority of purchases in brick-and-mortar stores (see chart, below right), many are tapping into the convenience of ecommerce as needed.

Some product categories that constitute low-involvement, shelf-stable staples are apparently becoming regular online purchases for many consumers. According to research from the Retail Council of Canada, consumers are most frequently buying the following grocery items online:

- Toothpaste (64%)

- Salty snacks (62%)

- Breakfast cereal (60%)

- Canned staples [vegetables/fruit/

soup] (58%) - Chocolate (52%)

While it will never replace the in-store experience entirely, digital grocery shopping is growing steadily as shoppers continue leveraging various services based on their need for convenience and time savings, in particular through the various fulfillment options now available (see chart, below.) They’re also using ecommerce for the quick delivery of emergency supplies, such as diapers, beverages, breakfast items and snacks.

Meanwhile, shopper expectations about customer experience, quality and service have grown exponentially in the last two years, according to Canadian Grocer.

Retailers are responding by rolling out various digital shopping experiences that address the growing need for consumers to shop and make purchases the way they want — while trying not to detract from the physical store experience. The ultimate goal is to make shopper interaction across every potential touchpoint an exceptional experience.

One key element of the improved customer experience involves meal preparation, since 39% of shoppers consider retailer foodservice a good substitute for a home-cooked meal and more than half (55%) express a desire for “hybrid” meal options blending scratch foods and prepared items, according to Canadian Grocer.

Loblaw Companies Ltd., for one, is piloting partnerships with restaurants such as General Assembly Pizza to provide restaurant-quality foods. Walmart has been partnering with Ghost Kitchen Brands for a service that lets customers “mix & match” from more than 20 well-known restaurant brands, including Quiznos and Saladworks, as well as CPG brands including Beyond Meat, Nescafe, Red Bull and Ben & Jerry’s.

ACTIONABLE IDEA:

Participate in the add-to-cart, digital sampling

and/or subscription-based ordering opportunities

conducted by your retailer partners.

______________________________________________________________

About the Author

Katherine Barks is VP-Strategy within the Retail Solutions team at The Mars Agency. She is a business strategist with 25+ years of diverse experience across the many facets of strategy, including consumer/ shopper behavior research, channel and category insight, retail strategy, customer experience design, and measurement best practice. A highly regarded marketer in North America, she has worked with many tier-one CPG clients such as Kimberly-Clark, S.C. Johnson, Unilever, Diageo, Heineken, Pfizer, Pepsi, Campbell Soup Company and General Mills.

In her current role, Katherine is focused on supporting retail strategists and retailer clients including Walmart Canada, Big Y and Hudson’s Bay.