By Brian Higdon, The Mars Agency

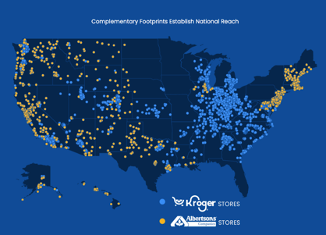

Oct. 14 could prove to be a momentous day for the retail industry with the announcement that Kroger is merging with Albertsons, creating by far the largest grocer in the U.S. and an operation that rivals Walmart in terms of both food sales ($209 billion vs. $218 billion) and store count (4,996 vs. 4,662).

While the transaction is expected to close in early 2024, the FTC approval process has just begun — and could require the combined Kroger-Albertsons business to spin off between 100 and 375 stores as a new public company.

Here is a look at some key takeaways from The Mars Agency’s perspective.

Because the Albertsons’ business is largely complementary, Kroger expects the merger to accelerate both its go-to market strategy and value creation model in the following ways.

Accelerated Go-to-Market Strategies:

FRESH: Kroger says the deal will let the company serve America with fresher food, faster.

Our Take: The combined supply chain and logistical power will deliver food from farm to store faster. Providing fresher products and thereby extending shelf life (and reducing shrink) will grow their leadership in the critical fresh arena.

OWN BRANDS: According to Kroger, the merger will create broader selection of own-brand products that “Offer customers higher quality and better value.”

Our Take: A portfolio of over 34,000 products will make the combined company one of the largest CPGs in the country, with products across all tiers (premium and opening price point, along with natural/organic).

PERSONALIZATION: A united company will offer customers best-in-class personalized experiences.

Our Take: With data on a total of 85 million households, there will be a greater opportunity to deliver personalized, relevant experiences.

SEAMLESS: It will deliver an enhanced, seamless customer experience requiring zero compromise.

Our Take: With the goal of creating “a single seamless ecosystem,” the merger gives shoppers far more choice in how, when and where to shop. The opportunity to learn also grows through expanded store formats, ecommerce executions and partnerships.

ENVIRONMENTAL, SOCIAL & GOVERNANCE (ESG): It will “power continued progress toward Shared ESG initiatives.”

Our Take: The larger operating footprint enables a greater ability to impact the people and communities they serve by combining Kroger’s “Zero Hunger Zero Waste” program with Albertsons’ “Recipe for Change” effort.

Source: Kroger

Strengthened Value Creation Model

“Grows core business to power the value creation flywheel.”

Our Take: The flywheel spins faster with a larger footprint and more shopper traffic.

“Expands national reach to accelerate alternative profit businesses like retail media.”

Our take: Those combined 85 million households grow the company’s opportunities around retail media, data commercialization and personal finance exponentially.

“Provides significant synergies to reinvest in customer and associate benefits.”

Our Take: There should be substantial savings through operational synergies and the elimination of duplication.

“Creates a path to deliver enhanced total shareholder returns.”

Our Take: That is, stronger stock prices and dividends. (Note: Kroger expects the transaction to be accretive to earnings in the first year after close and then reach double digits by year four.

Key Watchouts

Here are the areas we’ll be watching closely (after FTC approval, of course):

Retail Media: While the Albertsons Media Collective is relatively nascent, Kroger Precision Marketing (KPM) is one of the preeminent retail media networks in the nation. We therefore would expect to see fast movement in this arena.

Data & Analytics: The considerable power of Kroger’s 84.51 analytics will be turbocharged with data from Albertsons Just 4 U loyalty program.

Merchandising: Will Albertsons move toward a centralized model for assortment decisions? Will it move toward Kroger’s pricing model vs the current high-low strategy? (Kroger has already hinted at this possibility).

Store of the Community: Albertsons has emphasized local assortment with strong community ties. We would expect Kroger to continue this practice to help advance its own mission of driving community engagement and loyalty.

Market Competition: Kroger might use its new presence in the Northeastern U.S. to challenge rival Ahold Delhaize more than Albertsons has been doing.

Ecommerce: Will Kroger continue to work with Ocado to expand distribution centers to newly acquired regions or instead utilize Albertsons home delivery capabilities?

__________

About the Author

As SVP-Customer Development, Brian Higdon leads all of The Mars Agency’s grocery channel activity and serves as GM of the Cincinnati office, guiding a team of shopper marketing experts driving growth, ROI and strategic engagement with retailers for our key clients. Prior to joining Mars in 2018, Brian led an independent cross-functional team of consultants and analysts dedicated to the creation of new retail formats and market-winning strategies.