Targeting a younger, male-skewing audience? Look no further than your friendly neighborhood convenience store.

By Barb Seman, The Mars Agency

The following article looks at the unique shopper demographics and need states found in the convenience channel.

C-Store Quick Take: Unique Channel Opportunities

In most situations, the letter “F” carries pretty negative connotations. So having three of them on your scorecard might suggest your shopper engagement plan leaves something to be desired.

But if you’re a brand looking for ways to reach a younger, male audience, then responding to the demands of these shoppers for Food, Fuel, and Fast delivery might provide exactly what you need to win in the c-store channel.

If your target is Millennial and/or Gen Z shoppers, the c-store channel has them by the carloads. More than half (55%) of all U.S. men 18-54 and nearly half (45%) of women 18-34 visit c-stores on a regular basis. And Millennials and Gen Z’ers in significant numbers (44% and 12%, respectively) are using the channel as their go-to source for gas, snacks and drinks — and increasingly for groceries, personal care and household products as well.

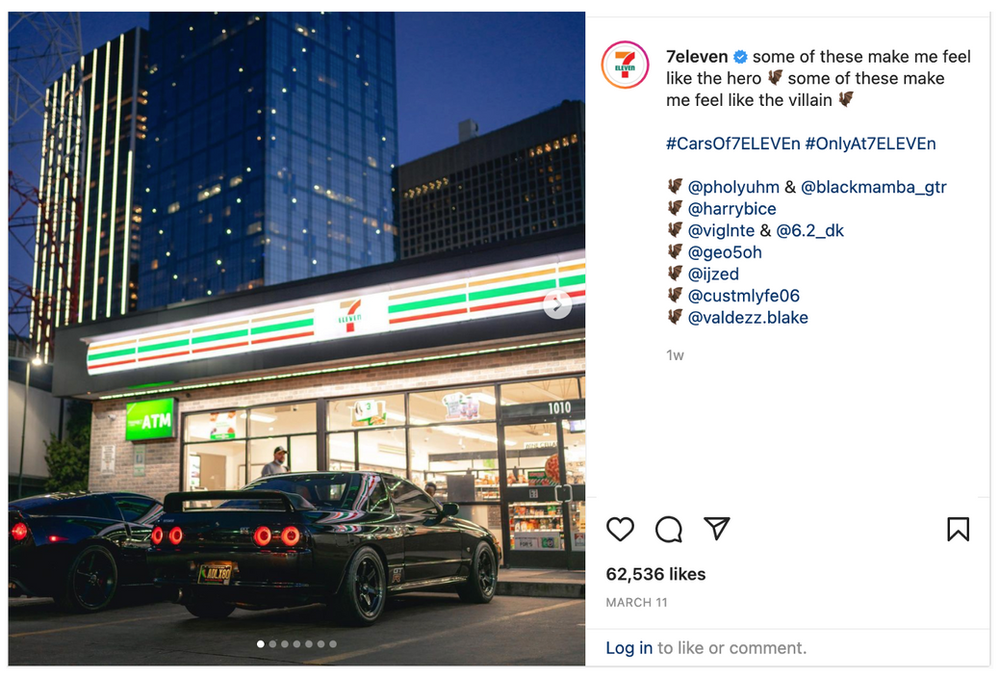

For evidence of how much the c-store has become part of the daily routine for some young consumers, spend a few minutes scrolling through 7-Eleven’s Instagram feed. (“If you went to 7-Eleven and didn’t take a pic, did you even go?” one follower asked recently.)

To become part of that routine, remember those three Fs:

1. FOOD

Frequent c-store shoppers visit to fulfill a wide variety of needs, including some of the staples for which the channel has long been known: lottery tickets, tobacco, and alcoholic beverages. But in terms of trip types, 66% of food and beverage purchases are for immediate consumption.

That last stat is why many chains put considerable effort into their foodservice offerings.

Both 7-Eleven and Circle K are making in-roads with young, Millennial parents with the fresh-food options they’re developing to compete with QSRs (quick-service restaurants) and meet these shoppers’ needs for “healthier” choices.

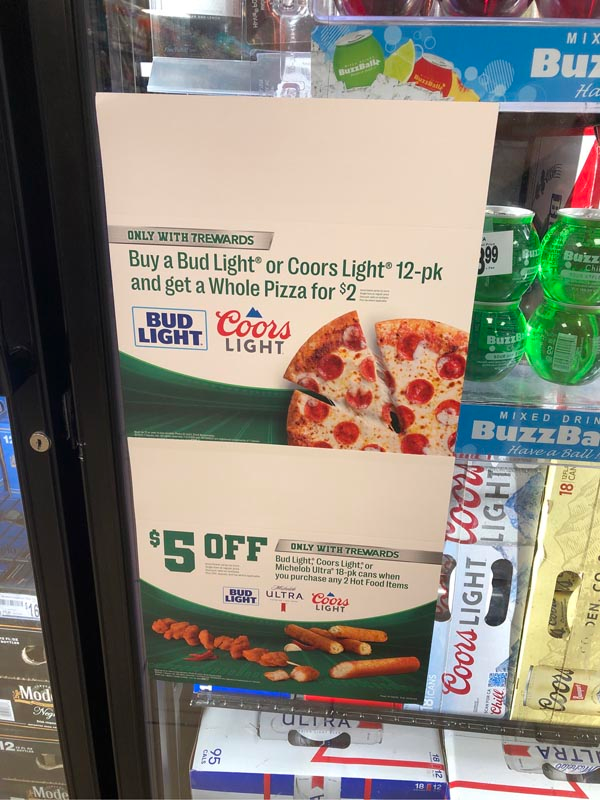

The opportunity for packaged goods brands is to find ways to bundle their products with fresh food offerings to create a meal solution that can drive “plus 1” purchases.

2. FUEL

Gas drives c-store visits. In fact, NACS (National Association of Convenience Stores) estimates that 80% of all fuel purchases in the U.S. occur at c-stores. 7-Eleven is the leader, with roughly 8% market share based on consumer traffic estimates (Circle K follows at 6.5%), according to Fuels Market News.

The trick for c-store operators is getting those gas buyers from the pump into the store — only 48% do, in fact, according to NACS.

Consumers have to buy gas; they don’t necessarily need to grab a beverage or snack.

But if buying a snack would earn them points to help manage their transportation budget, consumers might take note.

The opportunity for CPGs is to help retailers with gas discount and loyalty program offerings that will gain the attention of more consumers and give gas buyers an incentive to make their way into the store.

3. FAST(ER)

The name of this channel explains the primary appeal it has always had for consumers. Historically, there was no faster, simpler shopping experience than a quick trip to the corner convenience store.

But that’s not quite true anymore, now that quick-commerce delivery services have emerged to redefine convenience as a 15-minute wait on the couch for your Slurpee and snacks to arrive.

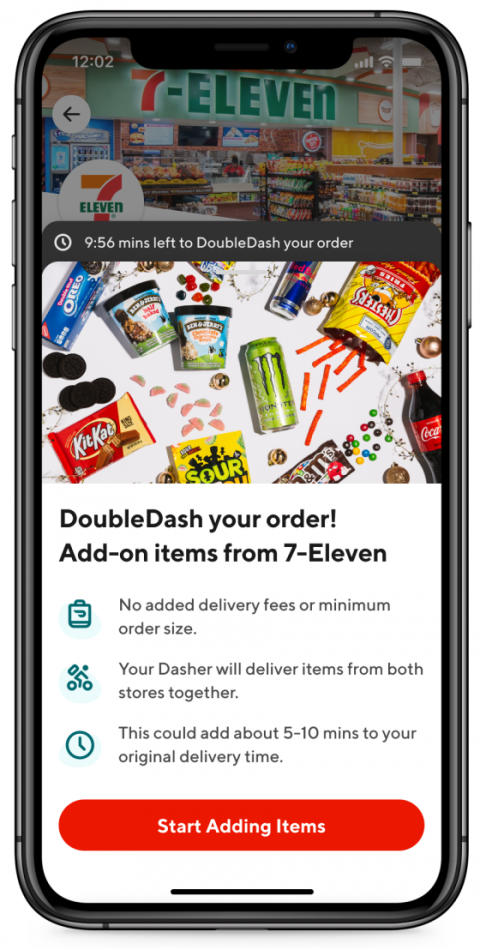

C-stores, therefore, are aggressively pursuing partnerships with these delivery services, including the creation of exclusive offerings with DoorDash, Uber, and other services aimed at delivering the ultimate shopper conveniences. One example is DoubleDash, in which DoorDash will swing by 7-Eleven (or Wawa, QuickCheck, etc.) to pick up some drinks or snacks while delivering your restaurant order at no extra charge.

Parents over-index on interest in ordering online from c-stores —especially Dads, whose use of the option has increased significantly over the last year.

The opportunity for CPGs is to help c-stores remain part of this “faster” shopping option by creating family meal offers and other deals exclusive to home-delivery shoppers.

Engagement Starters

Men, as marketers well know, are not highly engaged in the shopping trip. Typically mission-driven, it can be hard to grab their attention for another purpose. But they can be influenced in the moment with relevant messages and offers that don’t slow them down:

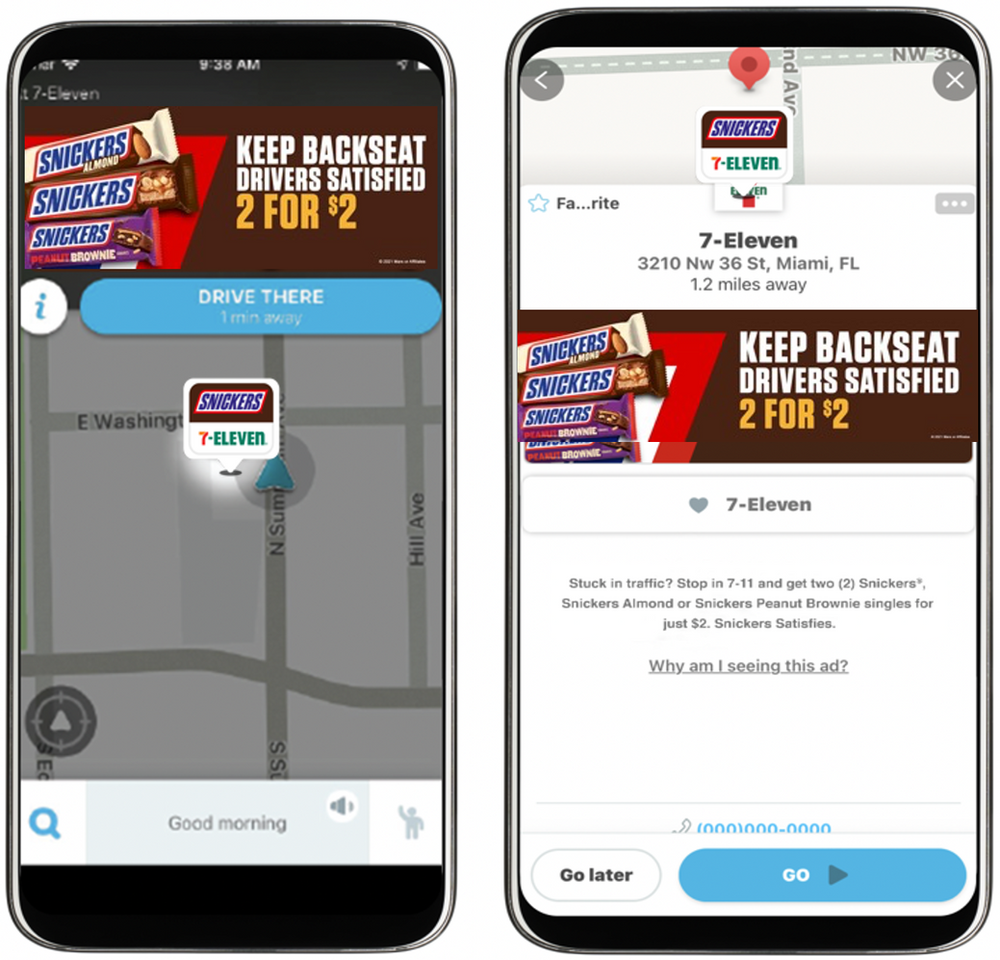

- Getting on their radar and being disruptive while they’re shopping are keys to driving a sale.

- While very digital and visual, they’re hard to distract from their mission, so visibility at the point of sale is very important.

- Their use of retailer mobile apps is very utilitarian: store location, hours, etc. But you can leverage that app engagement to connect across other platforms like text notifications, geo-targeted mobile ads, and other “real-time” means.

- Adapt your messaging to this male audience: Grab ‘em quickly with direct, to-the-point offers and messaging or they will move on.

- Parents over-index on interest in ordering online from c-stores — especially Dads, whose use of the option increased significantly over the last year. And dayparting is a big way to engage women, from quick stops for themselves in the morning to quick treats for their kids in the afternoon.

Speaking of content — not to mention words that begin with “F” — don’t forget to bring the “Fun.” Young males love gaming, and both official tie-ins with videogame platforms and titles, as well as proprietary digital games and contests, can be extremely effective at getting their attention.

Photo source: Path to Purchase Institute

Article Sources: The Mars Agency/Marilyn, Mintel, National Association of Convenience Stores

____________

ABOUT THE AUTHOR

Barb Seman is VP-Retail at The Mars Agency, where she leads our activity in the drug, dollar and specialty channels. She amassed 25 years of retail and agency expertise before joining The Mars Agency, serving as Vice President, Marketing for Jo-Ann Stores and Dollar Tree Stores, where she turned consumer insights into actionable strategies.

With a passion for retail, Barb leads her clients in building shopper solutions for growth that leverage digital, social and traditional channels. Her expertise spans multiple categories including food and beverage, personal care, health and wellness, home improvement, as well as navigating and managing retail media networks.