Insights and analysis about the holiday shopping season’s new unofficial kickoff from Mars United’s Marilyn Ecommerce Insights Suite.

To download the Prime Big Deal Days 2024 CPG Deep Dive, fill out the form below.

Amazon took credit for kicking off the 2024 holiday shopping season a full month early last week while releasing record-breaking results for its third annual Prime Big Deal Days, held Oct 8-9.

The blockbuster two-day sales event attracted a record number of Prime members, who spent more money and bought more items than the two previous Big Deal Days events, according to Amazon. The company mentioned national brands Dyson, Mattel, Levi’s, and Apple as contributing to the event’s success. It also called out smaller brands L’Ange Hair, Liquid I.V. and IT Cosmetics while noting that independent sellers in particular enjoyed record sales this year.

Numerator reported that 58% of Big Deal Days shoppers said they were very or extremely satisfied with the deals they encountered, with another 33% somewhat satisfied; 24% gave credence to Amazon’s boast of being a season-starter by acknowledging that they purchased gifts for the holidays during the event.

Also supporting Amazon’s claim is the fact that both Walmart and Target hosted their own major sales event this month in response to Prime Big Deal Days: Target sought to beat Amazon to the punch by hosting Target Circle Week sales for its loyalty program members from Oct. 6-12; Walmart tried to top both competitors by staging a Holiday Deals event from Oct. 8-13 that was open to all shoppers (with Walmart+ members receiving early access to the offers).

Holiday gifts may have been top of mind for many Big Deal Days shoppers, along with the potentially more self-indulgent pursuits of electronics, home items, toys, beauty needs, and apparel. But there also was plenty of shopping activity across frequently purchased consumer packaged goods categories.

As discussed in our Amazon Prime Day report last July, data from Mars UnitedSM Commerce’s Marilyn Ecommerce Insights Suite finds many Prime members using the retailer’s tentpole events to find deals on everyday household needs — and correspondingly, many CPG marketers leveraging the massive traffic these events produce to conduct special campaigns.

To track this activity, we’ve created a Prime Big Deal Days Deep Dive that covers 23 categories of frequently purchased products across

food, household goods, and personal care. The report uses data from Mars United’s Marilyn Ecommerce Insights Suite to identify the brands that had the greatest success engaging with Amazon Prime shoppers during the event.

Below is a brief look at some of those brands. The full Deep Dive report can be downloaded below.

Nail polish marketers Beetles, Modelones, and Saviland were among the top 5 brands in both promotional and sponsorship activity in the Foot, Hand & Nail Care, although only Beetles placed among the top five for share of sales growth. Saviland and Modelones were also among the most active brands in the Gift Sets category.

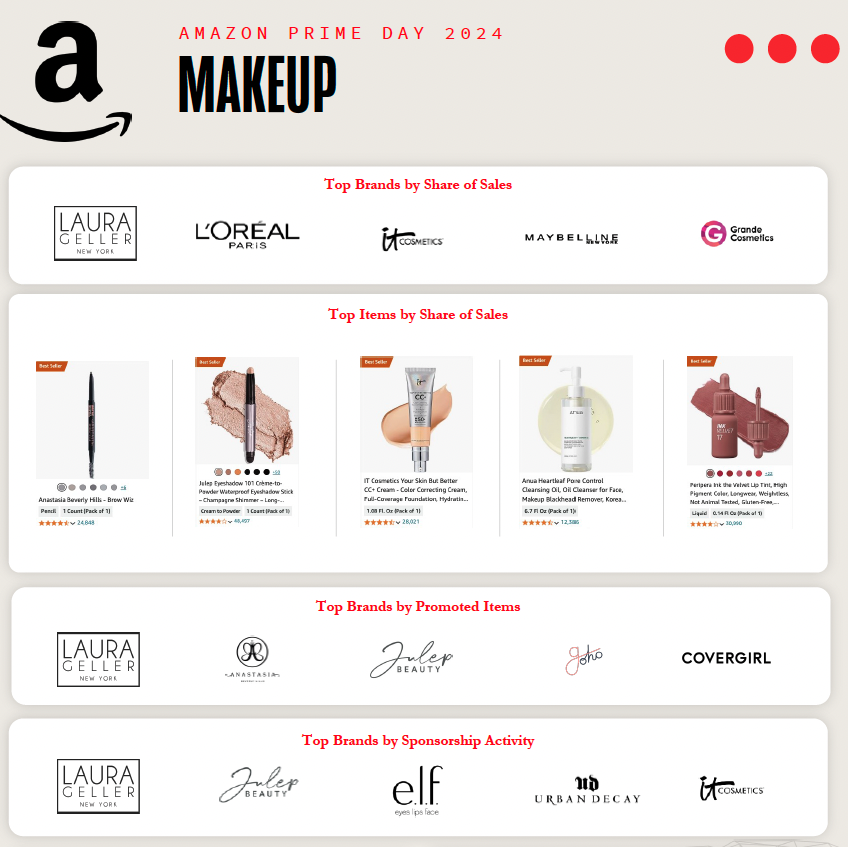

In Makeup, Laura Geller Beauty scored a trifecta by topping the brand ranks for share of sales growth as well as both promoted and sponsorship activity.

Procter & Gamble’s Crest toothpaste brand ranked highly in sponsorship activity and share of sales growth in both the Personal Care and more-specific Oral Care categories. But Philips Sonicare landed atop the share of sales growth list in both categories without any corresponding prominent presence in paid activity.

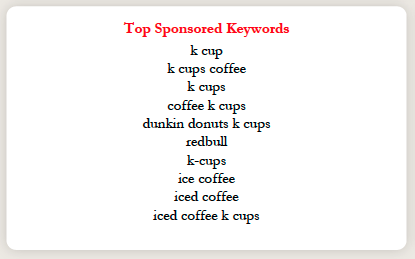

Elsewhere in Oral Care, Kenvue’s Listerine seems to be one a favorite for competitive targeting: the mouthwash brand was featured in five of the top 10 keywords that had the heaviest sponsorship activity. The same trend seemed to take place in Beverages, where “K-Cup” appeared in seven of the top 10 sponsored keywords — suggesting that the brand name for Keurig Dr Pepper’s line of at-home coffee pods has become a Kleenex-style synonym for the category.

In Shave and Hair Removal, P&G’s Gillette and Venus, along with the category-expanding Manscaped, topped the lists for shares of sales, promoted items and sponsorship.

Bread and Bakery: Oreo topped Sponsorship and Sales. A 30-pack of Oreo Chocolate Sandwich Cookies was among the top 5 items by share of sales.

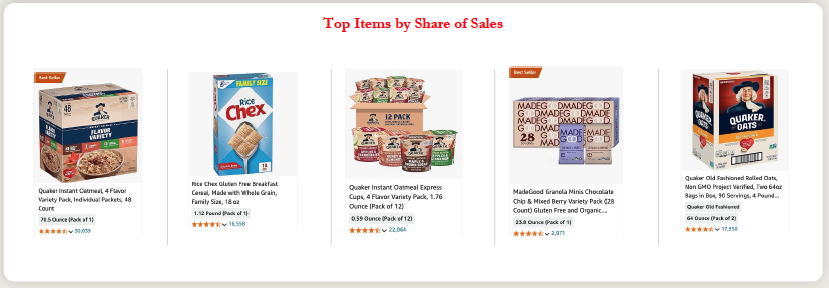

Pepsico’s Quaker dominated two categories. It was the top brand among both promoted and sponsored items in Breakfast Cereal, which likely helped the brand gain the number one spot in share of sales growth as well as three of the top five items by share of sales growth. And in the more general Breakfast Foods category, Quaker landed in the top five across sales, promoted and sponsored and likewise had three of the top five items in terms of sales share.

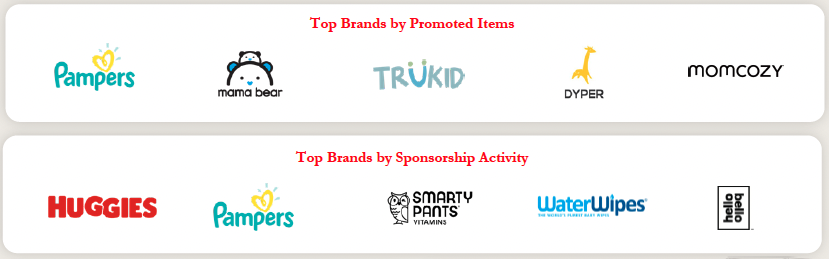

In Baby & Childcare, Pampers and Huggies continued their ongoing battle for diaper supremacy, with both featuring prominently in sponsorship activity and correspondingly in share of sales; Pampers was also the top-promoted brand in the category and had one top item. Amazon’s own Mama Bear diaper brand was also heavily promoted and earned a spot in the top five for share of sales.

In Diet & Sports Nutrition, Liquid I.V. was the No. 1 brand in share of sales and captured the top three items by share as well. The electrolytes drink-mix maker was also among the most-promoted brands — leading to the aforementioned callout from Amazon.

House Supplies was the only category where the “home team” came out on top, with Amazon Basics leading the way in both promoted and sponsorship activity and claiming the top spot in share of sales growth. Advertising activity otherwise didn’t seem to have much impact in this category, with national-brand icons Bounty, Charmin and Cottonelle placing in the top five for share of sales growth without any similarly high levels of promotional support.

Optimum Nutrition ranked No. 1 for share of sales growth in the Diet & Sports Nutrition category, where it also topped the list of most-sponsored brands. In Vitamins & Supplements, Optimum also placed in the top five for share growth without featuring prominently in either promotional or sponsorship activity.

Download the report by filling out the form below.

Brands can also use Mars United’s free Prime Big Deal Days Recap Tool to learn how they performed in any category during the event. This first-of-its-kind resource powered by the Marilyn Ecommerce Insights Suite delivers insights into sales, promotions, discounts, sponsored search, and other key metrics.

In addition, qualifying brands can request a 30-minute audit session with a member of the Mars United team to review their performance and gain insights into improving their strategy for the critical Cyber 5 sales event in November.